By JAMES COVERT

December 21, 2006; Page B1

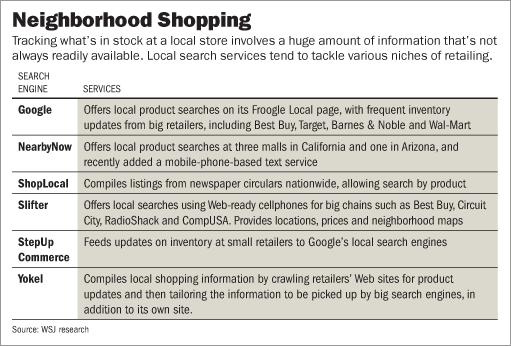

Now that shoppers are accustomed to scouring the Web for the best prices on everything from TV sets to handbags, a new breed of search engine aims to help them figure out which local stores have the goods in stock.

Last week, a company called NearbyNow began offering shoppers at three malls in California and one in Arizona a chance to check merchandise availability at most of the malls' stores by sending text messages from their cellphones. A similar service called Slifter, from GPShopper Inc., focuses on the availability of electronics and toys at big chains like Best Buy Co. and Staples Inc. Other companies, including Google Inc., are building networks to help shoppers figure out what's at local stores before they get there.

For some shoppers, the services have come in handy. Kharlo Barcenas, a 24-year-old construction-project engineer, says he used NearbyNow's service to quickly locate an Oakland As baseball cap at the Eastridge mall in San Jose, Calif., on Sunday. Since hearing about Slifter at a party in the spring, Jacob Silberstein, a 33-year-old legal recruiter from Queens, N.Y., has used it to buy a router at Circuit City and an iPod armband and a "Lord of the Rings" DVD set at Best Buy. "Some people see it and immediately get it," he says, noting that he has introduced the service to a half-dozen friends.

Online local searches have been around for a while, but they have been hit or miss, largely because inventory information at the store level is hard to get. A site called Yokel.com, for example, does a far better job of finding merchandise in its hometown of Boston than elsewhere around the country. Yokel Inc. Chief Executive Scott Randall says it will take a year for the company to cover the nation's 25 top metropolitan areas as well as the service covers Boston. And Shoplocal.com, one of the largest local shopping sites, plans to overhaul its site early next year to better highlight the local offerings it gathers from newspaper advertising circulars. Right now, those offerings are often mixed in with online deals.

It's been especially hard to collect information about designer clothes. In January, a site called BrandHabit.com plans to launch such a service. The hitch: It will focus on small designers and boutiques that are willing to participate because they need the exposure.

Some major retail chains that let customers check inventories at local stores on their own Web sites are also starting to share that information with search engines. And Google is working with Best Buy, Barnes & Noble Inc., Target Corp. and Wal-Mart Stores Inc. to make those chains' inventories more accessible online. Over the past year, its Google Base and Froogle Local programs have also amassed local inventory feeds from smaller businesses. Best Buy is involved because "it's really a convenience factor" for shoppers, says Rose Hamilton, the company's director of online marketing.

But a number of retailers, including some luxury stores, apparel chains, jewelers and supermarkets, aren't enthusiastic about making the information available. One reason is that the searches list prices, sometimes side by side with lower prices available online. Gap Inc. has "no immediate plans to implement it for a variety of reasons," says spokesman Alex Clark, adding that "there are some logistical difficulties to say the least."

NearbyNow was able to persuade retailers at the four malls it covers to participate in part because it shows only local results, says Scott Dunlap, founder and CEO of the Mountain View, Calif., company. By this time next year, he expects the service, which is free to shoppers, to be available for at least 100 malls. "It's a big hit with the teen 'mall rat' demographic" and chains like American Eagle Outfitters Inc. and Hot Topic Inc., Mr. Dunlap says. He adds that NearbyNow plans to offer information about new merchandise and markdowns starting this spring. "These kids do everything on their phones," he notes. American Eagle had no comment. Hot Topic didn't return phone calls seeing comment.

Companies eager to win more Web exposure for their products are helping to nudge the process along. Microsoft Corp., Eastman Kodak Co. and Intel Corp., which track inventories at some smaller retailers, are feeding the data to Channel Intelligence Inc., Channel says. The Celebration, Fla., company says it also collects local inventory information from chains like RadioShack Corp. and CompUSA. Channel then passes the data on to companies like CNET Networks Inc., a tech-oriented shopping-comparison site, and GPShopper.

GPShopper's Slifter service, which is aimed at techies and videogame enthusiasts, covers about 50 million products at 15,000 retail locations, GPShopper CEO Alex Muller says. He aims to expand into sporting goods, apparel and cosmetics. Other companies see an opportunity to publish data from smaller mom-and-pop stores. Over the past three years, StepUp Commerce Inc., based in San Francisco, has built a roster of about 5,000 small retailers that mainly sell appliances, furniture, high-end electronics and other items that aren't easily shipped. StepUp was recently acquired by Intuit Inc., which in October began including the local search service as an option in its Quickbook accounting packages.

At Leland Fly Fishing Outfitters LLC in San Francisco, year-over-year sales of rods, reels, waders and other gear have jumped nearly 50% since the shop began using the new service, says owner Josh Frazier.

But even Google hasn't always had an easy time collecting data. "It's evangelism and education more than trying to sell them anything," says Shailesh Rao, the director of local search for the Mountain View, Calif., company.

No comments:

Post a Comment